OUR WEALTHCARE SOLUTIONS

Grow your wealth management business

Quantifeed’s solutions bring benefits to customers, advisors, and portfolio managers. Our suite of functions is assembled and configured to create compelling digital advice propositions.

OUR WEALTHCARE SOLUTIONS

Grow your wealth management business

Quantifeed’s solutions empower CIOs, customers, advisors, and portfolio managers. Our suite of capabilities and services can be assembled and configured to create compelling digital advice propositions.

OUR PARTNERS

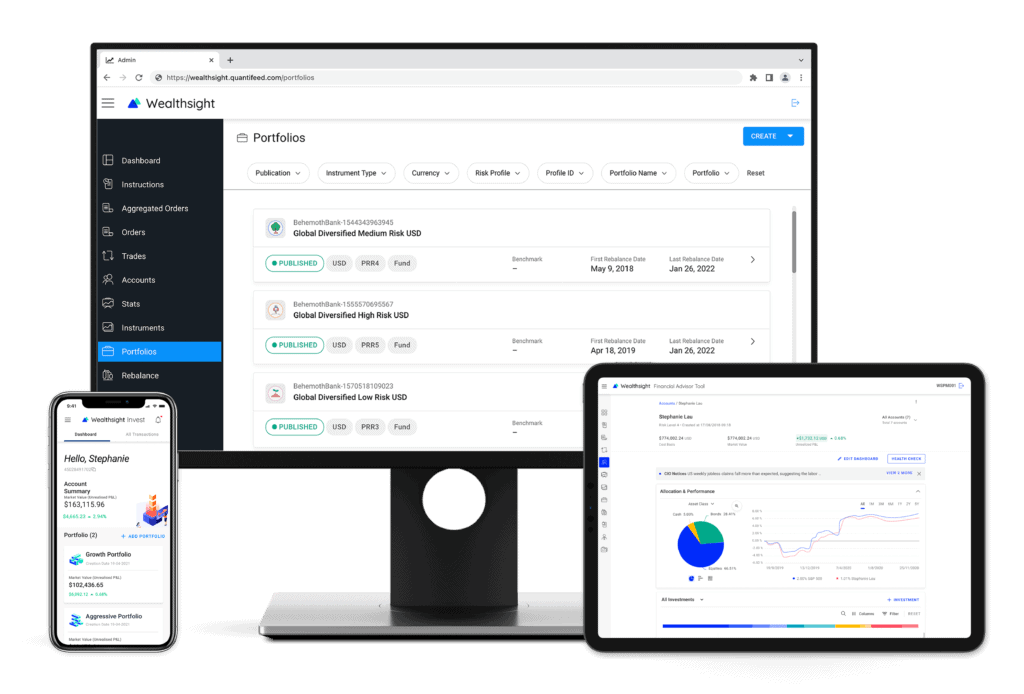

OUR PLATFORM

Our award-winning technology powers wealth management platforms to deliver engaging investment experiences at scale.

Build compelling wealth management propositions to service more customers, introduce efficiencies and grow your business.

WHY QUANTIFEED

The leading digital wealth management experts

We don’t just provide a platform, we deliver a total package. An end-to-end solution that includes all the necessary services that encompass intuitive design, sophisticated quant solutions, comprehensive portfolio analytics and continued consultation services. Our proven track record and strong understanding of the region’s business practices make us the best in the business.

Deep Expertise

Trusted by major financial institutions in the region, we understand the subtleties, regulations, and investment frameworks that enable our partners to transform and scale their wealth management business.

End-to-end Technology

As wealthcare experts, we simplify the complex back end and technology orchestration, presenting it as an easy and effortless way for customers to enjoy their investment journey.

Proven Track Record and Delivery

We know what it takes to launch a frictionless digital investment service. We deploy in any environment and can be set up and be ready to go quickly.

TECHNOLOGY

Configurable and modular technology for successful solutions

QEngine follows a modern architecture of loosely coupled services that are organised into multiple service layers. The platform uses an API-first and future-proof technology to enable multiple deployment models and deliver value to your business.

OUR ACCOLADES

Ready to start?

Speak to us today to find out how Quantifeed can help you transform your wealth management business.