Overview

The MASTR model portfolio is a long-only, multi-asset portfolio denominated in US dollars. It aims to systematically maximise portfolio diversification across ten of the most liquid sub-asset classes globally, including developed and emerging market equities, REITs, gold, investment-grade corporates and treasuries of different maturities. The portfolio rebalances monthly.

Selection

The diversification ratio is defined as the ratio of the weighted average of the volatilities of the assets comprising the portfolio divided by the volatility of the portfolio itself. The most diversified portfolio (MDP) is one which, under a given set of constraints, maximises this ratio over the chosen universe on each rebalance date. The logic performs selection in the sense that assets which do not increase this ratio receive zero allocation.

The universe consists of some of the largest, most liquid, cost-efficient and market-tested ETFs. These ETFs have been selected based on a number of criteria including quality & stability of their issuers (who are among the top-three global ETF issuers, namely Vanguard, BlackRock and StateStreet/SPDR), fund size (measured by AUM) & liquidity, performance, fees and length of trading history. The portfolio can also be built with other instruments such as indices, futures and OTC swaps (or with UCITS funds for EUR-denominated investors). Implementation can take several forms and be performed via managed accounts, a fund, or structured notes.

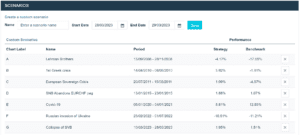

Performance

At inception, the portfolio’s benchmark was set to be the Morningstar Asset Allocation Total Return Index. The portfolio has returned 6.82% YTD (compared to 4.36% for the benchmark). The same comparisons for annualised vol and max drawdown are respectively 12.19% (9.67%) and -0.57%(-0.78%), so whilst the MASTR portfolio has a slightly higher vol during that period, the reward per unit of risk is significantly higher, and it draws down less than the benchmark. The 95% VaR is also favourable, having, since inception, a daily figure of -60bps vs -90bps for the benchmark.

Some noteworthy points about this portfolio:

- The portfolio is currently invested in six of the possible ten instruments (international equities, investment grade corporates and the belly of the yield curve recently offering no diversification benefits).

- Unlike in recent years, the asset weights are broadly consistent with their contribution to the portfolio’s market risk, which is interesting given bonds are expected to be far less volatile than equities.

- Over the last year, gold has been the largest driver of performance.

- Historically, the portfolio has a low beta (0.14) to the market.

Diversification In Perspective

The more uncertain the environment, the more important diversification is for investment purposes. Evidence suggests that thoughtful portfolio construction and systematic diversification can add considerable value to portfolios, especially during stressed times. It is important to note that re-balancing is also vital to ensure that the strategy captures this diversification benefit due to regime changes, as shown below:

Conversely, re-balancing too often may erode performance due to trading costs. For this portfolio, evidence shows that a monthly rebalancing frequency strikes the optimal balance between these two forces. See the performance comparison between no rebalance and weekly rebalanced versions below:

Rebalancing reduces total return since inception by 3.32% and 5.48% over the basic buy and hold strategy for monthly and weekly rebalancing respectively. However, the buy and hold strategy does not capture the benefits of rebalancing.

Quantifeed’s expertise lies in simplifying complex investment strategies and offering investors exposure to some of the most sophisticated allocation engines and exciting investment portfolios in the world.

To find out how diversification could help super-charge your portfolio, please get in touch, and subscribe to our newsletter for more insights on portfolio development and management.