The ageing effect in Australia presents attractive investment opportunities. The demand for services to the elderly, such as aged care, is expected to grow as the Australian population ages.

According to research conducted by Charles Sturt University, Australia is getting older. As a population it is ageing at an increasingly rapid rate. It is predicted that people aged 65 and over will comprise 22% of the population by 2057. That will mean 8.7 million older people by then, compared to 3.7 million in 2017. Across the social, political, and economic spheres, this trend will have a significant impact in everything from healthcare provision to transportation planning.

Due to increased average wealth levels, companies offering investment and asset management services can enjoy a boost in their business as the nation sees an increase in the elderly on their customer base. Innovative and technology-driven retirement income solutions will also ensure that the ageing population will secure their golden years comfortably, allowing them to spend and continue to contribute to the Australian economy.

Companies operating in geriatric healthcare or services that cater specifically towards improving the lifestyle of the elderly will look to benefit from the increasing average age of the Australian population. Stocks for companies that provide such services stand to profit as their business grows in line with an increased number of older-aged customers. Everything from dentistry to town planning will undergo shifts in practice, so the Ageing Population AU Strategy is taking a forward-looking approach in its selection of investments.

The Ageing Population AU Strategy selects stocks from sectors that cater to elderly consumers, such as cruise lines, funeral services, generic pharma, healthcare facilities, services and supplies, the healthcare supply chain, life insurance and medical devices. To improve the quality of the stock selection process, the strategy selects stocks that are covered by at least six equity analysts in the market with aggregated rating from hold to buy. The strategy contains up 30 companies and rebalances semi-annually.

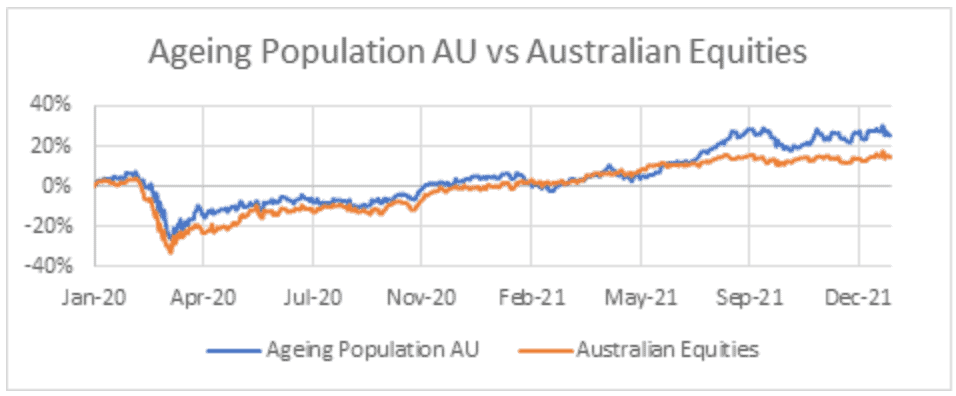

As of 12 Jan 2022, the return of the strategy over the last six month is 12.0% compared to 3.6% for Australia Equities. The one-year volatility of the strategy – a proxy for its short-term risk – is 16.3%, compared to 12.0% for AU Equities.

Quantifeed’s expertise lies in simplifying complex investment strategies to offer investors access to some of the most exciting strategies in the world. Subscribe to our newsletter for more insights on portfolio design and management.