In the fast-paced world of wealth management, aligning clients with model portfolios is a challenging task. Many advisors struggle to meet clients’ personalised service expectations due to limited tools and platforms that support tailored strategies. This often results in clients hesitating to make necessary changes to their portfolios. Quantifeed’s Next Best Action Engine is set to change the game by addressing these pain points and empowering advisors and their clients with better decision-making solutions.

The NBA features provides piecemeal steps to optimise a portfolio subject to the client’s requirements and constraints. This allows clients to navigate changes at their preferred pace and enhances their decision-making. Through data-driven insights, it equips both advisors and clients with actionable information to make informed portfolio decisions.

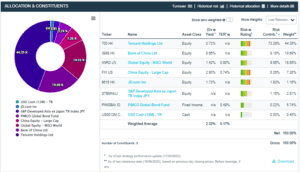

The engine can consume powerful risk and portfolio analytics to provide recommendations on how to improve the “health” of the client’s portfolio relative to a recommended model or reference portfolio. Real-time visualization, including historical and projected performance and risk analytics, serves as an interactive solution for advisors and clients.

Our NBA Engine can be integrated with a broader platform to mitigate inefficiencies arising from fragmented systems and manual processes. This elevates advisor productivity and effectiveness. The platform can bring together portfolio construction and personalisation, advice and proposal generation, and order management, all of which are critical steps to ensuring a seamless client experience.