In order to adopt and retain a healthy investment strategy, investors should periodically measure the performance of their investment portfolios and analyse the type of risks that may impact their investments. To do this, Quantifeed has developed a feature that will enable financial advisors to perform a health check for their clients. This form of portfolio management helps advisors to point out areas for improvement while enhancing customer engagement.

Portfolio Risks

An investment portfolio is created when a client invests in a combination of assets. Like every investment, the portfolio could either reap returns and fulfil the client’s financial goals, or it could incur losses. There is a chance (or a risk) that the portfolio may not meet the client’s financial goals- this is known as Portfolio Risk. Risks can never truly be avoided, so periodic portfolio health checks by financial advisors can minimise it as much as possible.

Benefits of Portfolio Health Check

Advisors often lack the time and access to the relevant data sets to conduct a deep dive into their clients’ investments. Quantifeed’s Portfolio Health Check has a simple and comprehensive dashboard that facilitates all this. It allows Advisors to give highly personalised analyses and recommendations to their clients. Its customer profiling engine can indicate client preferences or special interests toward certain investments, helping Advisors stay on top of portfolio management and offer appropriate solutions to their clients.

Advisors are notified when client health checks are due. Whenever a client’s portfolio starts to drift from its original model allocation, a prompt will be sent. This frees up the Advisor’s time to focus on building their business, increasing their productivity. During one-on-one meetings with the client, Quantifeed’s Portfolio Health Check enriches meetings, keeping it interactive. It improves client-advisor relationships and enhances the client experience as they are better equipped to service them backed with relevant data and recommendations.

Quantifeed’s Portfolio Health Check

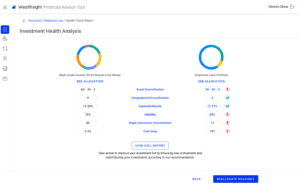

Just like a body health check aims to measure a person’s health, Quantifeed’s Portfolio Health Check does an overall analysis of a client’s portfolio to measure its performance. It allows Advisors to go deep in analysing the overall positions of their client’s investment and compare its current portfolio of assets to a model allocation that is recommended for them. Depending on their risk profile, each client’s portfolio will be modelled after a portfolio that reflects their risk appetite.

Quantifeed’s Portfolio Health Check helps Advisors to point out areas of improvement in their client’s portfolio and adopt a healthy investment strategy. Through time and market movements, a client’s portfolio will experience drift. When a client’s portfolio strays from its original position, a rebalance is needed to ensure that their portfolio isn’t exposed to unnecessary risks. Quantifeed’s Portfolio Health Check is a feature Advisors can utilise to do this. It is a digital tool Advisors ought to take advantage of to stay up to date with portfolio management and when servicing their clients to add value to client-Advisor relationships.

Easy Launch and Execution, Quick Results

To conduct a portfolio health check on our platform is easy and intuitive. It was designed to simplify the process for Advisors in seven steps.

Step 1: Launch Portfolio Health Check

Simply bring up a client’s profile and start the health check journey right away or from the Advisor Dashboard.

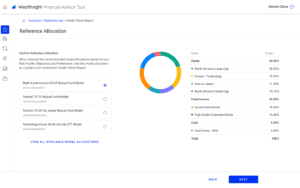

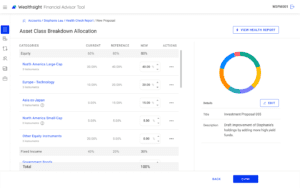

Step 2: Choose Reference Allocation Model

QEngine will automatically recommend a model based on the client’s profile, but Advisors may choose a different model against which they would like to test the customer portfolio.

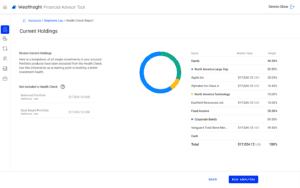

Step 3: Select Inclusions and Exclusions

Further fine tune the analysis personalisation by manually adjusting the client’s assets to include or exclude certain holdings. All this can be done before starting the comparison analysis.

Step 4: Kickstart Health Check Analysis and Share a Detailed Report

Generate a detailed six-axis report. Directly share the report with the client through their preferred channels including mobile.

Step 5: Adjust Portfolio

The health check provides personalised portfolio adjustment recommendations. Easily adjust new instruments to include within the newly reviewed portfolio structure.

Step 6: Re-test Allocation with Portfolio Health Check

Confirm that the new allocation complies with the model. Advisors may continue to adjust and test several approaches against the model to reach an ideal allocation.

Step 7: Order Management

When the Health Check is complete, clients are advised to take the next best step by making the change to their portfolio. Once their client consents and agrees to the adjustments, order generation for asset relocation can be done in just one click.

This final step leverages QEngine Trading to generate and process the relevant orders needed. QEngine Trading is one of seven capabilities within QEngine, an award-winning technology platform developed by Quantifeed. It supports the end-to-end trade and order management process from the investor to trading venue, to settlement and reconciliation. Learn more about it here.

Portfolio Health Check Monitoring

Portfolio management is an ongoing process, requiring periodic monitoring to ensure customer portfolios are brought back to the recommended state, continuously meeting the investor’s objectives and goals. After the first health check, QEngine performs ongoing and automatic portfolio monitoring and covers both absolute and relative performance. This frees the Advisor to focus on business and relationship building, increasing productivity and efficiency.

Keen to know more about Quantifeed’s Portfolio Health Check to improve wealth managers’ customer engagement? Reach out to us to schedule a demo! Our team is ready to demonstrate an interactive walk-through on how the Health Check works and how it can improve client-advisor meetings.