Welcome to Portfolio of the Month! This quarter, Quantifeed highlights Cyber Security companies in the United States.

One of the advantages to living in a highly interconnected world is convenience. This convenience also means threats to cybersecurity are everywhere. Cybersecurity initiatives are essential for protection, especially for large organisations that store individual data and personal information.

By 2028, the global cyber security market size is expected to hit USD 366.10 billion, exhibiting a CAGR of 12% during the forecasted period. An increasing number of e-commerce platforms and the growing integration of machine learning and cloud services are main contributors to the market’s growth. Increasing government investments in internet security solutions are anticipated to stimulate market growth as well.

Everyone connected to the Internet needs cyber security, making for lucrative opportunities for those in the business. The Cyber Security US Portfolio consists of equal weighted US-listed stocks with market capitalisation over USD 50 million and daily liquidity greater than USD 5 million over the last six months. Stocks covered by at least six equity analysts with aggregate ratings from hold to buy are selected. Up to 20 stocks that derive most of their revenue from the Cyber-Security related themes such as network security software and customer premise network security equipment are chosen.

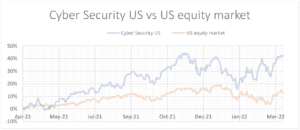

As of 4 April 2022, the annualized return of the strategy over the past one years is 43.8% compared to 13.0% for US Equities. The one-year volatility of the strategy – a proxy for its short-term risk – is 25.5%, compared to 14.7% for US Equities.

Quantifeed’s expertise lie in simplifying complex investment strategies and offers investors the exposure to some of the most exciting investment portfolios in the world. Subscribe to our newsletter for more insights on portfolio development and management.

Visit www.quantifeed.com to learn more about what we can do for your wealth management business in Asia and beyond.