These days, investment portfolios can be easily managed on an app. Investors can start investing in a portfolio from the comfort of their home, on their personal mobile screen. A well-diversified portfolio include equities, bonds, and other asset classes. Depending on risk appetite, each of these assets can be allocated and rebalanced appropriately in a portfolio to garner great potential returns!

What is Portfolio Rebalancing?

Rebalancing is the process of realigning the weightings of a portfolio of assets back to the recommended levels. It goes hand in hand with portfolio management and it involves periodically buying or selling assets in a portfolio to maintain an original level of asset allocation or risk. Over time, recommended portfolios experience drift or tracking errors, changing the original allocation of the recommended portfolio. It is important to ensure that your original allocations remain in order to safeguard against being overly exposed to undesirable risks and take advantage of opportunities to sell high and buy low (source).

When it comes to it, there are two main indicators of interest when maintaining a peak-performing portfolio- drift and tracking error.

What is Drift?

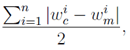

Portfolio drift is when natural market movements cause your investments to stray from your original or strategic asset allocation. For example, one asset class may have done extremely well, causing it to be overweighted in your portfolio. Drift is then calculated by the sum of one-sided difference between the customer’s portfolio and recommended portfolio, using the formula

What is Tracking Error?

Tracking error is the difference between the price behaviour of a portfolio and the price behaviour of its recommendation. It specifies how closely the first follows the second. The best measure is the standard deviation of the difference between the portfolio and its recommendation.

The tracking error formula is given by:

![]()

(Source)

This is often in the context of a hedge fund, mutual fund, or exchange-traded funds (ETFs) that did not work as effectively as intended, creating an unexpected profit or loss.

Portfolios are susceptible to drifts and tracking errors. In fact, drift will start on the following day after you buy a portfolio. As an investor, you’d want to be notified if there was significant change in your portfolio so that you can rebalance to keep to your asset allocation. It is a vital role of a fund manager, and in part a responsibility of the investor, to monitor their portfolios for drift and to understand when it is happening.

When Should You Rebalance?

What is the threshold of drift or tracking error that needs to be placed to ensure that portfolios are performing well? How do fund managers determine what a good drift threshold is, and when is it sensible that customers are alerted in that instance? Frequent alerts can cause fatigue and acting on every small drift incurs transaction costs.

The question on threshold was presented to us by a client, so our quant engineers used Geometric Brownian Motion (GBM) to model price movements and applied simulations to demonstrate drift behaviour. It allowed the team to have a rough idea about the shape of drift distribution and how detrimental it could be in extreme cases. In analysing tracking error, the team applied historical data backtests to produce a more accurate overview. Results show a general trend indicating that tracking error increases while drift rises, with several caveats and dependencies of each data set.

The truth is, there is no one-answer-fits-all. The answer depends on the portfolio, product, and experience of the Advisor managing the funds. The lower the threshold, more notifications will be sent. This can easily make investors frustrated, causing them to ignore these notifications, then put off rebalancing until it’s too late. On the other hand, when drift threshold is set too high, fewer notifications are sent but this could be detrimental to portfolio performance.

We have found the right balance through quantitative analysis. It is the key to an optimally performing portfolio.

Why Automation in Wealth Management Is Worth It

If you are looking for a digital wealth management solution that can address these issues, Quantifeed has the intellectual property and know-how to tackle this. The complex work of figuring all that out is done by our quant engineering team. Our Quant Services team then advises our clients to come up with the right threshold, allowing them to provide the best product and service to their customers. This keeps clients pleased with the way their portfolios are performing and managed.

This means Advisors need not manually manage notifications for their customers. The platform does it automatically, tremendously increasing efficiencies. Depending on the business requirement, QEngine can be automated to monitor and rebalance each customer portfolio timely and appropriately. We have configurable technology to help our clients come up with the right approach.

When we work with financial institutions to develop a compelling wealth management proposition, we configure QEngine to meet their business and technology requirements. A well-developed and holistic solution tailored to their needs can also be explored via QDiscovery, our design-led consultancy service.

Quantifeed has been making the complex simple for investors and financial institutions since 2013. Behind a great looking wealth management app is highly complex orchestration of algorithm, intelligence, and processes. QEngine has made the investing experience a delightful one for customers, seamlessly bringing together the complex back-end with the front-end.

Want to know more about Quantifeed’s Quant Services? Get in touch with us today or visit www.quantifeed.com to learn more.