We are proud to announce our Series C funding round led by HSBC Asset Management’s alternative investments business, HSBC Alternatives. HSBC AM is joined by Daiwa PI Partners and current shareholders, including global asset manager Franklin Templeton and global investment firm LUN Partners Group.

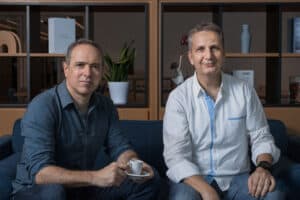

“We are thrilled to have the support of new and existing investors who believe in our business model and want to support our growth. We’re using these funds to strengthen our leadership in the automated generation and implementation of financial advice,” said Alex Ypsilanti, Quantifeed’s CEO and Co-Founder. “Quantifeed’s mission is to help financial institutions become providers of wealthcare, a customer-centric wealth management service that makes investing easy, accessible and relatable for everyone.”

The funding underlines the strength and growth trajectory of Quantifeed. The funds will be used to strengthen our solutions for advisors, portfolio managers and end-customers. We intend to enrich our capabilities in portfolio design, advice and trading engines, and enable wealth management across a broader set of asset classes including structured products, private equity and digital assets. As part of our expansion plans, we will accelerate talent acquisition across the Asia-Pacific region, particularly Japan and Southeast Asia.

Kara Byun, Director of Venture & Growth Investments at HSBC Asset Management, shared, “We are excited to have invested in Quantifeed and look forward to supporting the company in their growth. Quantifeed has already developed a strong suite of digital wealth management solutions backed by cutting-edge technology and are well positioned to capitalise on the growing demand for such services in Asia. The investment will give our clients and investment partners exposure to high-quality growth opportunities.”

We are proud to have come this far in our journey and remain excited to bring new and innovative products and solutions to the market! “Our success to date has been built from strong financial engineering expertise and a focus on scaling delivery to multiple clients and markets” said Ross Milward, CTO and Co-Founder of Quantifeed. “This funding round allows us to further accelerate our platform innovation and provide clients with rich capabilities and deployment options across cloud and enterprise.”

Coupled with powerful modular technology that will support any wealth management business, QEngine’s vast capabilities can transform digital wealth management businesses easily and quickly. Join us in our journey in bringing wealthcare to everyone! Follow us on LinkedIn and sign up for our newsletter below.